Counterfeit money is illegal, causing financial losses and potential fraud charges, with potential jail time and penalties under IPC Section 489C.

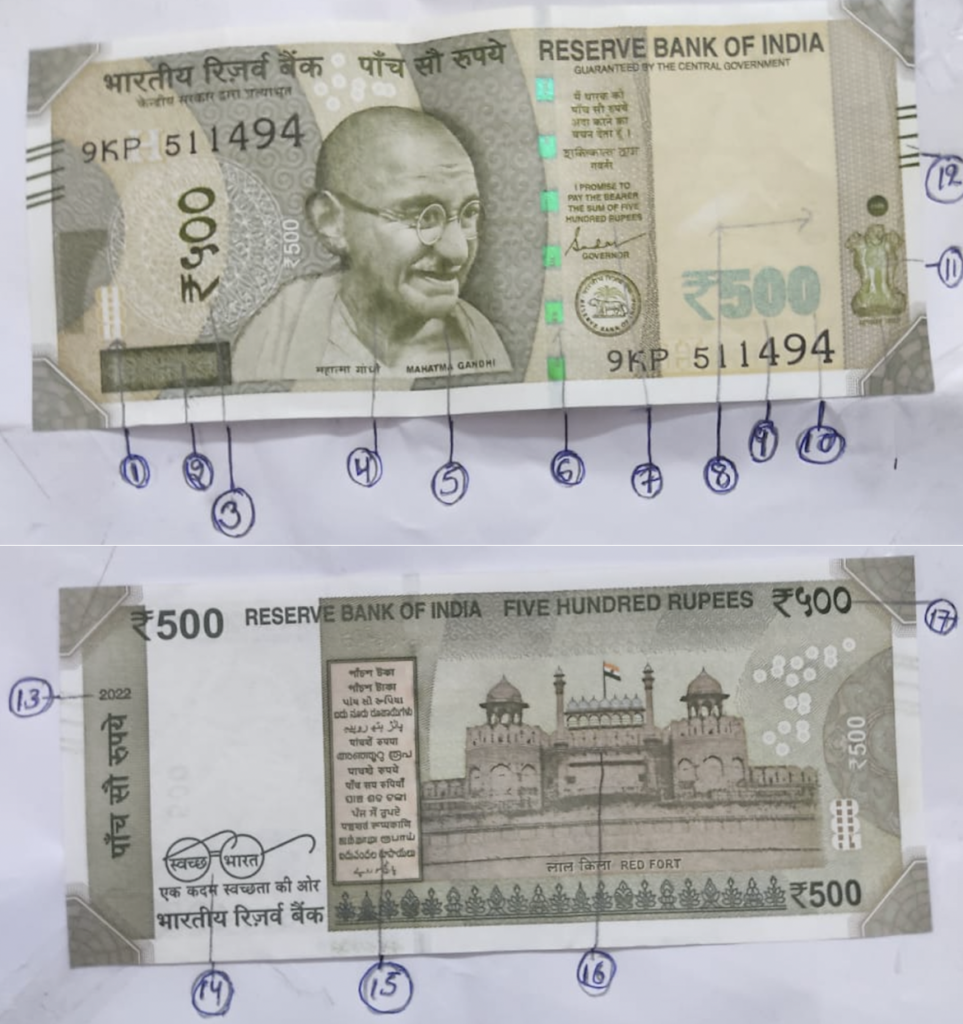

RBI suggestions to check Rs 500 note real/fake:

- See-through register(floral pattern registered on note front and back) with denominational numeral 500.

- Latent image with the denomination numeral 500.

- The amount of the denominational number 500 written in Devanagiri.

- Portrait of Mahatma Gandhi at the centre.

- Micro letters Bharat (in Devnagri) and ‘India’.

- ‘Bharat’ (in Devnagri) and ‘RBI’ are written on a color-shift windowed security thread. When the note is tilted, the thread’s colour changes from green to blue.

- Guarantee clause, governor’s signature with promise clause, and RBI emblem towards the right of Mahatma Gandhi’s portrait.

- Mahatma Gandhi’s portrait and electrotype (500) watermarks.

- Number panel on the top left and bottom right with numbers in increasing front.

- On the bottom right, there is a denominational numeral with the rupee symbol (Rs. 500) in a color-changing ink (green to blue).

- Ashoka pillar emblem on the right.

- Some features for the visually impaired.

- The leftmost note’s leftmost note’s printing year.

- Swacchh Bharat logo with slogan.

- Language panel.

- Motif of Red Fort.

- Denominational numeral 500 in Devnagri.

Additional information: The base colour of the note is stone grey and the size of the note is 63mm x 150mm, as per RBI.

General guide lines to detect fake currency :

- Feel the paper: Genuine Indian currency notes are printed on high-quality paper that feels distinct. They are made of 100% cotton fiber and have a unique texture. Counterfeit notes might feel different, smoother, or stiffer, as they are often printed on lower quality paper.

- Observe the watermark: Hold the currency note against a light source and look for a distinct watermark. Genuine Indian currency notes have a watermark of Mahatma Gandhi’s portrait and the denomination value. The watermark should be visible without the need for additional light sources.

- Check the security thread: Each Indian currency note has a security thread embedded in it. The thread appears as a continuous dark line when held against the light. It is integrated into the paper and contains the words “Bharat” and the denomination value in Hindi.

- Verify the latent image: Tilt the currency note at a certain angle to observe a latent image effect. On genuine notes, you will see the denomination value and the word “RBI” (Reserve Bank of India) appearing alternately when the note is tilted.

- Inspect the micro-lettering: Examine the currency note carefully to find micro-lettering, which is the small text printed on certain areas of the note. It should be sharp and clear on genuine notes but might appear blurred or smudged on counterfeit ones.

- Look for the color-shifting ink: Some Indian currency notes have color-shifting ink used for certain elements such as the denomination numeral. Tilt the note to see if the color changes from one shade to another. Counterfeit notes may lack this feature or exhibit poor color-shifting quality.

- Check for the see-through register: Hold the currency note up to the light to see a complete design of the denomination numeral on the left side, which matches the main design. Counterfeit notes might not have this feature, or the design might not align correctly.

- Examine the printing quality: Genuine currency notes have sharp and clear printing with intricate details. Counterfeit notes may have blurred images, uneven borders, or missing details. Look for any signs of poor print quality or irregularities.

Keep in mind that while these methods offer a fundamental manual identification process, they might not be perfect. If you think a currency note is false, it’s best to rely on cutting-edge counterfeit detection techniques or seek advice from a bank or other financial institution.